Legislative Approval on Tax Increase

On April 4th, the Maryland legislature passed a state budget that includes significant increases in taxes on a broad spectrum of tobacco products, as highlighted by the Baltimore Banner and The Washington Post. The changes are scheduled to take effect on July 1.

Details of the E-cigarette Tax Hike

The tax rate on e-cigarette devices will see an increase from a current rate of 12% to 20%. However, the tax on e-cigarette liquids will maintain its current rate at 60%.

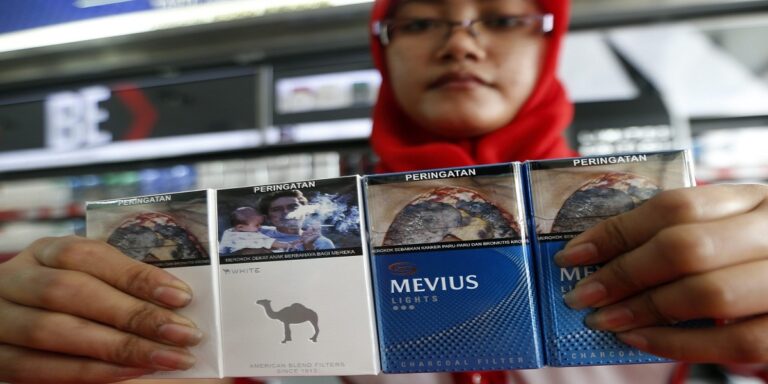

Increase in Traditional Tobacco Product Taxes

For traditional tobacco products such as cigarettes, the tax increase is notably substantial. The tax per pack will rise by $1.25, setting the new state tax rate at $5 per pack. Other tobacco products, including hookah, pipe tobacco, and snuff, will experience a tax increase from 53% of the wholesale price to 60%.

Objective of the Tax Increase

The principal aim behind escalating the taxes on cigarettes and other tobacco products is to deter tobacco usage, particularly among the youth. This move is aligned with public health initiatives aimed at reducing the prevalence of smoking and its associated health risks.

Awaiting Governor’s Approval

The budget bill, incorporating these tax increases, now awaits the signature of Governor Wes Moore, who has previously expressed his endorsement of these fiscal adjustments.