On May 29, the Russian Ministry of Finance submitted a bill proposing an excise tax on liquid nicotine and alcohol-related products. According to Vedomosti, this bill aims to improve control over the tobacco market and reduce illegal activities by making liquid nicotine a taxable item. This move could significantly impact the production, import, and sale of nicotine products in Russia.

The Proposed Bill and Its Objectives

Inclusion of Liquid Nicotine as a Taxable Item

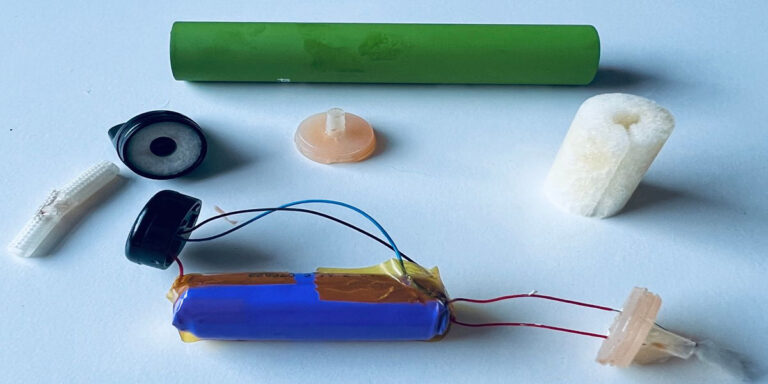

The core of the proposed bill is to classify liquid nicotine as a taxable item under the excise tax system. Currently, liquid nicotine is not subject to excise tax, which has allowed tax evasion and illegal imports to flourish. By amending the Tax Code and related legal documents, the Ministry of Finance aims to close this loophole.

Raw Material Deductions for Nicotine Products

To support legal producers, the bill includes provisions for raw material deductions. Companies using liquid nicotine in their production processes can receive tax benefits, reducing their financial burden and ensuring a steady supply of legal nicotine products in the market.

Impact on the Tobacco Market

Combating Illegal Nicotine Products

One of the primary objectives of the excise tax is to curb the market for illegal nicotine products. By imposing a tax on liquid nicotine, the Ministry hopes to reduce tax evasion and bring more transparency and regulation to the market.

Regulation of Imports

The document notes that there are currently few companies importing liquid nicotine. The introduction of an excise tax will make it easier to monitor and control these imports, reducing illegal activities and ensuring that only legally compliant products enter the market.

Stakeholder Reactions and Recommendations

Federal Antimonopoly Service (FAS) Involvement

The Federal Antimonopoly Service (FAS) has already responded to the proposal, recommending an analysis of its potential impact on the nicotine products market and related industries. This suggests that there is significant interest and concern about how the new tax will affect various stakeholders.

Ministry of Industry and Trade’s Role

While the Ministry of Industry and Trade has not yet received the bill, it is actively participating in discussions. This involvement is crucial to ensure that the policy is both reasonable and feasible, balancing the need for regulation with the interests of the industry.

Challenges and Considerations

Impact on Legal Producers

While the raw material deductions aim to support legal producers, the new tax could still pose challenges. Companies will need to adapt to the new regulatory environment, and the financial impact of the tax will need to be carefully managed.

Market Adaptation

The market will need to adapt to the new tax regulations. This could involve changes in pricing, supply chain adjustments, and potential shifts in consumer behavior as the costs associated with nicotine products change.

FAQ

What is the main objective of the new bill submitted by the Russian Ministry of Finance?

The main objective is to impose an excise tax on liquid nicotine to reduce tax evasion, regulate the market, and combat illegal nicotine products.

How will the excise tax impact the import of liquid nicotine?

The tax will help monitor and control imports more effectively, reducing illegal activities and ensuring that only compliant products enter the market.

What are raw material deductions, and how will they benefit companies?

Raw material deductions are tax benefits for companies using liquid nicotine in production, reducing their financial burden and supporting the supply of legal products.

What role does the Federal Antimonopoly Service (FAS) play in this proposal?

The FAS has recommended analyzing the impact of the new tax on the nicotine market and related industries to ensure a balanced and effective policy.

How will the new tax protect consumers?

By regulating the market and reducing illegal products, the tax will ensure that only safe, compliant nicotine products are available to consumers.

What challenges might legal producers face with the new tax?

Legal producers may face financial and operational challenges as they adapt to the new regulatory environment and manage the impact of the tax.