Rubicon Organics Inc., Canadian cannabis company, discloses flat revenue and losses in its first-quarter 2024 financial report due to seasonal softness and consumer confidence challenges.

Optimism Amidst Challenges

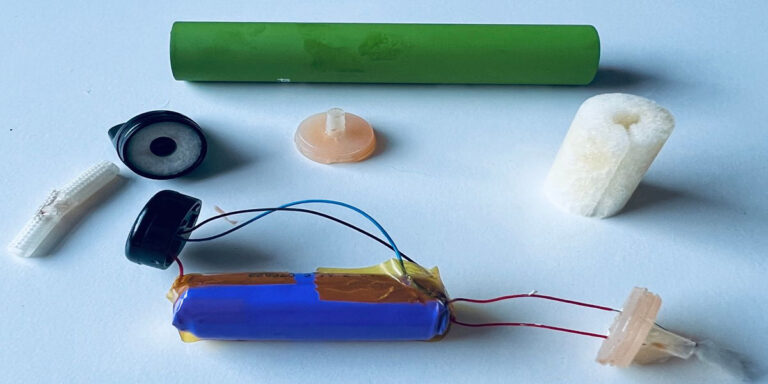

Despite the challenges, Rubicon sees potential growth opportunities with its new 1964 Supply Co. brand full-spectrum extract e-cigarette products, receiving initial orders from key provinces like Alberta, British Columbia, and Ontario.

CEO’s Vision

CEO Margaret Brodie projects a return to positive adjusted EBITDA in the second quarter, leveraging the e-cigarette market for revenue expansion and market consolidation.

Strategies for Future Growth

To counteract the decline in gross profit, Rubicon plans to focus on high-margin products and commits to enhancing performance despite negative operating cash flow.

Financial Outlook

Chief Financial Officer Janis Risbin plans debt refinancing and continued investment in growth throughout 2024, anticipating year-on-year revenue growth while maintaining positive operating cash flow.

Conclusion

Despite challenges, Rubicon Organics Inc. anticipates growth with innovative e-cigarette products, strategic financial restructuring, and market expansion efforts.