Starting June 1, 2024, the Bureau of Internal Revenue (BIR) in the Philippines will enforce new e-cigarette tax rules, marking a significant step in the government’s efforts to regulate the industry and combat illegal transactions. This move is expected to impact manufacturers, importers, and vendors as the BIR implements stringent measures to ensure compliance with tax laws.

E-cigarette Tax Stamp Enforcement

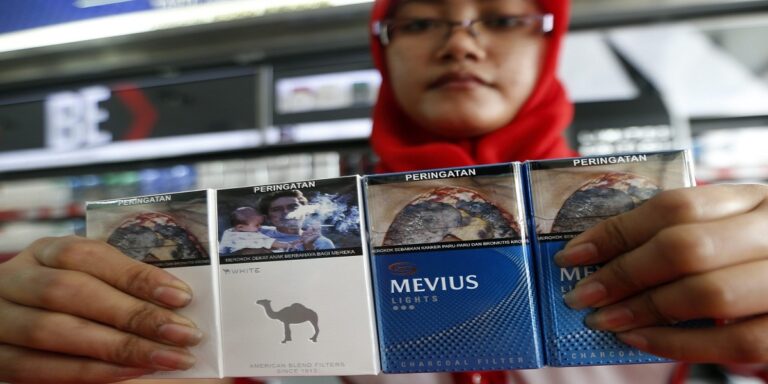

From June 1, 2024, all e-cigarette products sold in the Philippines must carry a tax stamp to verify proper tax payment. The BIR will confiscate any e-cigarette products found without these stamps, with owners facing legal consequences.

Deadline for E-cigarette Tax Compliance

E-cigarette manufacturers and importers are required to comply with the tax stamp rules by June 1, 2024. Starting May 8, 2024, stakeholders can order the new tax stamps. This timeline provides a clear framework for businesses to align their operations with the new tax regulations, avoiding penalties.

Supervision and E-cigarette Tax Penalties

The BIR will start strict supervision of the e-cigarette market in June, focusing on ensuring that all products comply with the tax stamp requirement. Non-compliance will lead to severe penalties, including fines and potential criminal charges for tax evasion.

Addressing Illegal E-cigarette Sales

The introduction of the e-cigarette tax stamp is part of broader efforts to combat illegal sales and ensure all market participants adhere to the law. Since 2022, the BIR has conducted multiple raids and legal actions to clamp down on non-compliant activities.

Commitment to E-cigarette Tax Law Enforcement

Director Lumagui of the BIR has reaffirmed the agency’s zero-tolerance policy towards the sale of untaxed e-cigarettes. This stance underscores the Philippine government’s dedication to enforcing tax laws and ensuring that all businesses contribute fairly to national revenues.