Haleon has announced the sale of its nicotine replacement therapy (NRT) business outside the United States. This $630 million deal with a subsidiary of the Indian pharmaceutical giant Dr. Reddy’s represents a strategic shift for Haleon, allowing the company to streamline its operations and focus on other core areas of growth.

Details of the Sale

On June 26, 2024, Haleon confirmed the divestiture of its NRT business, valued at £500 million ($630.25 million), to Dr. Reddy’s. This transaction is part of Haleon’s strategy to reduce business complexity and reinforce its emphasis on other strategic health product categories .

Key Points:

- Buyer: Dr. Reddy’s, an Indian pharmaceutical company.

- Sale Value: £500 million ($630.25 million).

- Focus Shift: Haleon will concentrate on its core growth areas post-divestiture.

Background on Haleon

Haleon was spun off from GlaxoSmithKline (GSK) and completed its listing in 2022. The company focuses on a variety of consumer health products and is known for its robust portfolio of globally recognized brands.

Main Brand Categories:

- Oral Health: Includes brands like Sensodyne.

- Vitamins and Supplements: Centrum is a leading brand in this category.

- Pain Management: Features products for pain relief.

- Respiratory Health: Includes treatments like Theraflu.

- Digestive and Other Health Products: Covers a range of health-related products .

Haleon’s NRT Business

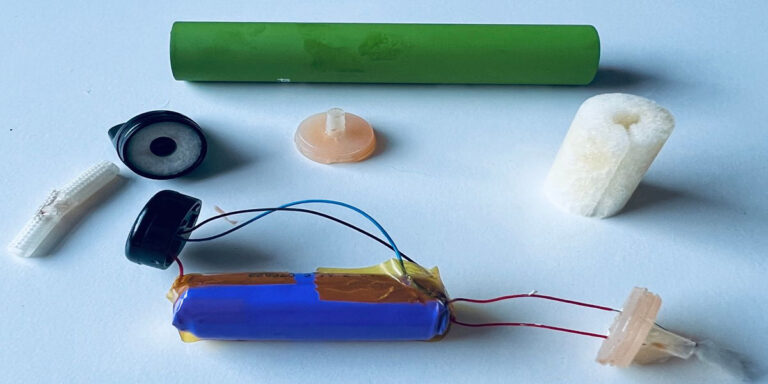

Haleon’s NRT products, known for their safety and effectiveness, include smoking cessation aids like Nicorette nicotine gum, patches, and lozenges. This segment has been a significant part of Haleon’s portfolio, offering effective solutions for those looking to quit smoking .

NRT Products:

- Nicorette Gum: A popular choice for smokers aiming to quit.

- Nicotine Patches: Provide a steady release of nicotine to ease withdrawal symptoms.

- Lozenges: Another effective form of nicotine replacement.

Strategic Implications of the Sale

This divestiture marks a strategic pivot for Haleon, enabling the company to streamline its operations and focus on areas with higher growth potential.

Benefits for Haleon:

- Reduced Complexity: Simplifies the business structure by exiting the NRT category outside the U.S.

- Focused Growth: Allows for a stronger emphasis on other strategic health areas.

- Financial Flexibility: Provides capital that can be reinvested into core growth areas .

Benefits for Dr. Reddy’s:

- Market Expansion: Enhances its portfolio and market presence in the NRT segment.

- Global Reach: Strengthens its position in the global consumer health market .

Market Reaction and Analysis

The sale has been positively received by the market, with analysts noting the strategic benefits for both companies. Haleon’s decision to divest a non-core segment is seen as a move that will allow it to allocate resources more efficiently and drive growth in more profitable areas .

Analyst Insights:

- Bloomberg Valuation: Previously estimated the NRT business could be valued as high as $800 million.

- Strategic Alignment: The sale aligns with Haleon’s long-term strategic goals .

Future Prospects for Haleon

With the NRT business sold, Haleon is expected to focus on its remaining brand categories, leveraging its strong market position to drive growth. The company’s well-established brands in oral health, vitamins, and supplements, pain management, respiratory health, and digestive health are likely to see increased investment and innovation .

Growth Areas:

- Oral Health: Continued expansion of the Sensodyne brand.

- Vitamins and Supplements: Strengthening the Centrum product line.

- Pain Management and Respiratory Health: Innovating and expanding product offerings.

FAQs

Why did Haleon sell its NRT business?

Haleon sold its NRT business to reduce complexity and focus on strategic growth areas.

Who bought Haleon’s NRT business?

The NRT business was acquired by a subsidiary of Dr. Reddy’s, an Indian pharmaceutical company.

What products are included in Haleon’s NRT business?

The NRT business includes smoking cessation products like Nicorette gum, patches, and lozenges.

How much was the NRT business sold for?

The NRT business was sold for £500 million ($630.25 million).

What will Haleon focus on after the sale?

Post-sale, Haleon will focus on its core areas such as oral health, vitamins and supplements, pain management, respiratory health, and digestive health.